nd sales tax rate 2021

Gross receipts tax is applied to sales of. BISMARCK North Dakotas farmers and ranchers who have sold or are considering selling livestock because of drought face the prospect of a higher income tax bill due to the unplanned sales.

State Income Tax Rates Highest Lowest 2021 Changes

The consideration received in respect of the service provided in the case of a.

. Before the official 2022 Oklahoma income tax rates are released provisional 2022 tax rates are based on Oklahomas 2021 income tax brackets. HR Block prices are ultimately determined at the time of print or e-file. Thu Jul 01 2021.

Oklahoma OK Sales Tax Rates. Projected global life expectancy 1990-2100. The tax rate of the fuel that is used for equivalent purposes applies.

Expand all Collapse all Languages and formats available. Passports travel and living abroad. See Credit recapture next.

Money and tax. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. The per litre energy content of these fuels is typically lower than that of the equivalent fuel.

HR Block Maine License Number. Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck will change for sales and use tax purposes effective January 1 2021. Canadians are required to file an income tax return for the previous year by April 30 May 2 nd for.

Consumers will turn more frequently to cross-border sales leaving less business. 2022 Tax Rate. 09 cents per milligram for other product types 275 cents per milligram for edibles 635 retail sales tax plus 3 municipal sales tax.

To determine the sales tax rate your business will charge start with your states revenue agency. We welcome your comments about this publication and suggestions for future editions. This leads to a higher per litre tax rate for new fuels.

Rates may differ for different goods and services you offer so be sure youve checked the details. Ohio OH Sales Tax Rates. Ontario Energy and Property Tax Credit and Ontario Sales Tax Credit.

City of Bismarck North Dakota. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. 2021 HRB Tax Group.

Oklahoma tax forms are sourced from the Oklahoma income tax forms page and are updated on a yearly basis. Also effective October 1 2022 the following cities. The latest sales tax rates for cities in North Dakota ND state.

Fri Jan 01 2021. Moreover the mandatory tax. Income Tax Calculator - How to Calculate Income Taxes Online for FY 2020-21 AY 2021-22 with ICICI Prulifes Income Tax Calculator.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Prices do not include sales tax. Check with your municipality as well many particularly large cities and some counties also charge a sales tax.

Ontario Seniors Public Transit Tax Credit. Retail sales are expected to begin by the end of 2022 Taxes. If all your sales are at the reduced rate then the reduced rate will.

NW IR-6526 Washington DC 20224. HI LA ND and VT do not support part-year or nonresident forms. Refunds received after 2021 and after your income tax return is filed.

Alabama Tax Forms for 2021 and 2022. The 2022 state personal income tax brackets are updated from the Oklahoma and Tax Foundation data. North Dakota ND Sales Tax Rates.

Rates include state county and city taxes. Fri Jan 01 2021. The tax rate itself is important and a state with a high sales tax rate reduces demand for in-state retail sales.

This page provides detail of the Federal Tax Tables for 2020 has links to historic Federal Tax Tables which are used within the 2020 Federal Tax Calculator and has supporting links to each set of state. If you have a North Dakota Sales Tax Permit please use ND TAP to submit any sales and use tax you owe when you file your return. Use Income Tax Calculator India for free.

Possession of up to 15 ounces will be allowed beginning July 1 2021. Local Taxing Jurisdiction Boundary Changes 2021. If anyone receives a refund after 2021 of qualified education expenses paid on behalf of a student in 2021 and the refund is paid after you file an income tax return for 2021 you may need to repay some or all of the credit.

The rate of sale tax you paid must be the same as the general sales tax rate otherwise you can only deduct the general sales tax rate. The Finance Act 2020 introduced Digital Service Tax DST at the rate of 15 of the Gross Transaction Value GTV effectively from 1 st January 2021. Pursuant to Ordinance 6417 as adopted June 23 2020 the boundaries of the City of Bismarck will change for sales and use.

Degree of urbanization 2021 by continent. Sales Tax Rate. Prepare for a new rate of 125 from 1 October 2021 to 31 March 2022.

Use Tax By State. The Nebraska state sales and use tax rate is 55 055. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Up to 45142. 2020 rates included for use while preparing your income tax deduction. Special federal income tax rules are available to producers who find it necessary to sell more livestock than they normally would because of drought.

Floridas corporate income tax rate declined from 55 to 44458 percent in September 2019 effective for tax years 2019-2021. Death rate worldwide 2019. Sales Tax By State.

Political Contribution Tax Credit. Excise Taxes By State. County Sales Tax Rates.

Excise Tax of 0625 cents per milligram of THC for cannabis flower. The GTV is defined as. Countries with the highest birth rate 2021.

North Dakota Sales Tax Rates By City County 2022

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

North Dakota Income Tax Calculator Smartasset

2022 2023 Tax Brackets Rates For Each Income Level

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Ebay Taxes An Overview Guide Quickly Learn Everything You Need To Know

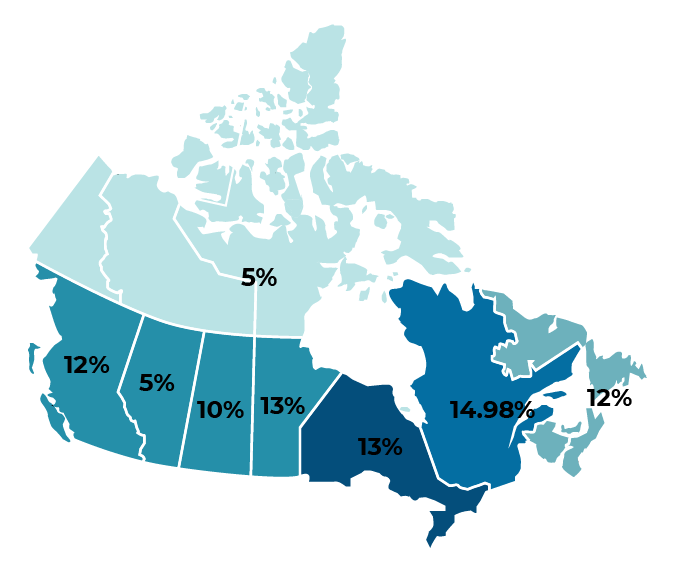

Which Province In Canada Has The Lowest Tax Rate Transferease

State Corporate Income Tax Rates And Brackets Tax Foundation

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation